Central bankers are the only economic policymakers whose influence has grown since the 2008–’09 financial crisis. Yet by themselves, central banks lack the tools to balance economic management and macroprudential oversight. They hover in a gray area between monetary and fiscal policy, but the question is, For how much longer? Central banks deserve our empathy, not our criticism, as their independence is slowly being compromised.

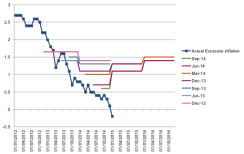

Despite unprecedented monetary policies, inflation targeting has been a key macro theme around the globe. It is becoming increasingly hard to model, explain and predict the course of economic events, however, including the main current headline: low inflation (chart 1). It is not difficult to see why.

Chart 1: ECB's Forecasts Increasingly Wide of the Mark

Source: Eurostat; combined ECB and Eurosystem staff inflation forecasts

The globalization of output, trade, technology and financial flows has made economic growth and inflation for individual countries increasingly a function of global trends. As a result, traditional domestic economic relationships, such as the Phillips curve trade-off between inflation and employment, have become less important or less reliable. Some countries, such as the U.K., now have ostensibly tight labor markets that under typical conditions would lead to a call for the abandonment of zero interest rates, and yet there is unusually weak wage and salary formation that would make such a move highly contentious.

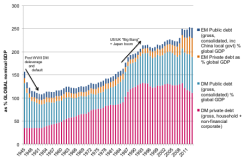

Moreover, the debt overhang (see chart 2) in many developed and in some emerging countries is dead weight on growth and inflation. In many major emerging markets, the slower economic expansion has been primarily noncyclical. Price pressures are wilting under the impact of cumulative demographic trends in many large economies, especially in Europe and Asia. The effect of aging populations so far conforms to theoretical predictions of slower potential growth and lower household savings rates, but in practice, the latter is being offset by the strong desire to save by companies and governments.

Chart 2: Global Debt Levels Change the Economic Environment

Source: GDP — IMF, World Bank, Madison Project; Government debt — Abbas et al (2011, IMF), Reinhart & Rogoff; Private sector debt — National Authorities via Haver and CEIC, BIS quarterly series, Schularick & Taylor; External EM Debt — WB/BIS/IMF Joint Debt Hub; China — PBOC, Standard Chartered

China’s role in global deflation is also of increasing significance as past turbocharged growth gives rise to a hangover of heavily subsidized excess industrial capacity and debt. The deflationary consequences of economic change in China are already evident in an oversupply of many raw materials and in downward pressure on selling prices at home and in foreign markets (see chart 3).

Chart 3: The Common Factor of G4 Inflation Now Moves with Chinese Prices

Source: Bloomberg, Investec Asset Management; Common factor of G4 inflation is the first principal component of %y-o-y headline CPI from U.S., U.K., France and Germany.

This global deflationary environment is undermining the basic premise of modern central banking: namely, that monetary policy can eliminate deviations between sometimes volatile actual inflation and the more stable behavior of inflation expectations. National central banks are also wrestling with conflicting policy goals. To pursue targeted inflation rates, they deploy quantitative easing, zero interest rates and other policies designed to boost bank lending. But these measures are playing second fiddle to the implementation of new domestic and internationally coordinated policies of macroprudential oversight, by which banks are required to delever their balance sheets. The outcomes include high bank but reduced market liquidity and lower risk premiums but less efficient capital markets, which feed fears of future instability.

National central banks are not in an enviable place, and we still expect too much of them. If they cannot credibly quantify the outlook for growth and inflation and deliver favorable outcomes, there is a danger they will lose our trust. Of all the major central banks, the Federal Reserve appears to be the closest to meeting these challenges. This key factor is probably underpinning the expectation of a modest rise in interest rates and the rally in the U.S. dollar that is dominating financial markets. But all central banks need to regain the intellectual initiative by defining the debate regarding global and structural economic forces and by asserting forcefully the limits to what they can realistically achieve and the responsibilities of other public authorities.

This imperative will be of growing importance as the next economic downturn draws nearer. Some people already anticipate even more aggressive quantitative easing, including what is known as helicopter money. When economist Milton Friedman coined the phrase “helicopter drop” in 1969, he did so in the context of a world in which the private fractional reserve banking system played a much smaller role in driving money creation than it did subsequently. Today we have returned to conditions closer to those that prevailed when Friedman was writing, largely because of the constraints over the supply of and demand for bank credit because of the debt overhang and macroprudential deleveraging. In the next recession — likely within five years — a true helicopter drop may require formal and direct coordination between the monetary and fiscal authorities to ensure that newly created base money makes its way into the economy and the nominal value of income. That will mark the end of central bank independence as we know it.

Mike Hugman is a strategist on the emerging-markets fixed-income team at Investec Asset Management in London. George Magnus is an independent economist based in London.

Get more on macro.