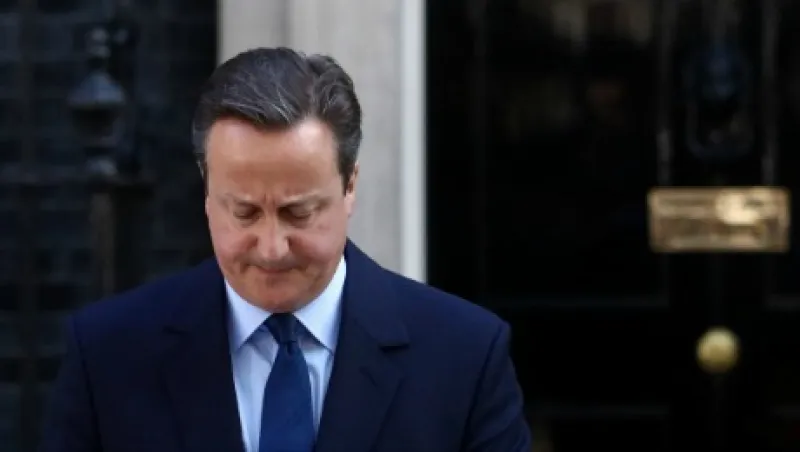

Investors awoke today to a new reality after the U.K. referendum on European Union membership ended with a decision to depart the 28-nation bloc and the possible division of Scotland. Prime Minister David Cameron resigned in response to the vote with a departure to be effective in three months. Markets reacted sharply to the results with the pound zterling reaching its lowest point in more than 20 years versus multiple benchmark currencies. Both the Bank of England and the European Central bank have already announced measures to tame currency volatility while the Swiss National Bank intervened this morning already after a nearly 7 percent rise for the franc versus the pound. With months of negotiations ahead of the EU and the U.K. as they negotiate the costliest divorce in history, the question facing investors is whether this new development will leave interest rates locked at historic lows indefinitely as policymakers attempt to mitigate any damage.

Chinese outlook for easing cools. A quarterly survey of lending officers at Chinese banks conducted by the People’s Bank of China showed the impact of improving activity, with just more than 20 percent of respondents anticipating that further easing actions by the central bank will be necessary. Separately, total assets among Chinese lenders as tracked by the China Banking Regulatory Commission expanded by 15 percent year-over-year in May, according to a report released today.

IMF Warns U.S. on wealth divide. In a report issued this week, the International Monetary Fund gave a thumbs up to the U.S. economy in general while criticizing a growing divide between wealthy and impoverished citizens that could ultimately undermine growth prospects. Economic researchers at the Washington–based organization lowered U.S. GDP estimates for full-year 2016 to 2.2 percent from a prior 2.4 percent, based on external drivers.

Twilio IPO heartens tech sector. Yesterday mobile messaging software firm Twilio debuted as a public company with a share price increase of 90 percent in the first day after the company was priced above the initial range shopped by underwriters. The auspicious start is welcome news to venture capitalists after concerns over so-called unicorns, highly valued private companies, have become a major investor narrative this year.