< The 2016 Hedge Fund Rising Stars

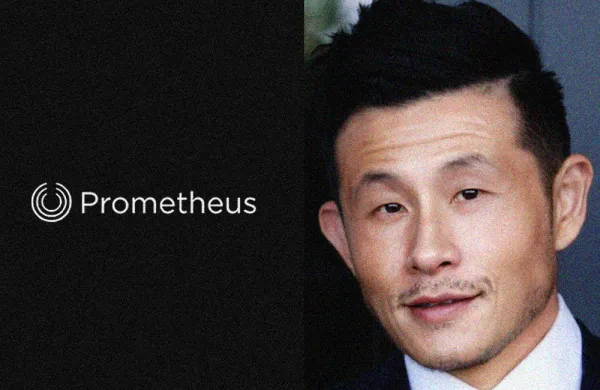

Michael Wang

Cypress Funds

For the first six months after Michael Wang joined hedge fund firm SAC Capital Advisors in 2007, his boss wouldn’t let him pick a long stock. All of Wang’s trading ideas had to be shorts. This discipline gave Wang, who came to Stamford, Connecticut–based SAC after two years doing mergers and acquisitions at Citigroup in New York, a great ability to sell short.

Taiwan-born Wang, 33, was three when he and his family moved to Southern California. In Taiwan his father had been an engineering professor and his mother had taught English, but in the U.S. they made their living by trading stocks and invested in real estate. That early exposure to the market kick-started Wang’s own interest: He became president of his high school investing club before heading east to attend New York University’s Stern School of Business, where he majored in finance with a minor in psychology.

Wang stayed at SAC until 2012, when Jason Karp, a former portfolio manager with the firm, recruited him to join Karp’s new outfit, New York–based long-short equity hedge fund Tourbillon Capital Partners. As day-one employee and a principal, Wang was contributing to Tourbillon’s success when an even more intriguing opportunity came his way: The Cypress Funds asked him to be portfolio manager and co–managing partner in the management company.

Los Angeles–based Cypress Funds might not be a household name, but its founder, and Wang’s co–managing partner, certainly is. The grandson of Superior Oil Co. founder William Myron Keck, Robert Day launched the firm in 1969; two years later he founded Trust Co. of the West. Day, 72, sold TCW to French bank Société Générale in 2001. Although he remained TCW chairman, a role he gave up only in 2013, he was bound by a noncompete agreement, so Cypress Funds was unable to raise outside capital. He stepped down from TCW after deciding to relaunch his hedge fund, which he did in 2014. Wang took over as portfolio manager in May 2015. Despite challenging markets, the fund, which currently manages about $400 million, is off to a positive start, helped by Wang’s short-selling prowess.

Visit the 2016 Hedge Fund Rising Stars: Ivy League Schools Pave the Way for more.

Hedge Fund Rising Stars of 2016

Millennium Mgmt

Aristeia Capital

AIG Investments

Point72 Asset Mgmt

Pershing |

Sciens Capital Mgmt

Graticule Asset Mgmt Asia

Margate Capital

Ropes & Gray

Mariner Glen Oaks |

University of California

Blue Harbour Group

White Square Capital

TT International

Jana Partners |

George Weiss Associates

Aksia

Etho Capital

Utah Retirement Systems

Squarepoint Capital |

Green Owl Capital Mgmt

Blackstone Group

MetLife

Fortress Investment Group

MSD Partners |

Viex Capital Advisors

Marto Capital

New York State Common Retirement Fund

Cypress Funds

Polar Asset Mgmt Partners |

| |