Last summer parents of young children with diabetes got some relief when the Food and Drug Administration approved the first fully mobile glucose monitor for patients as young as 2. Known as the Dexcom G5, the monitor sends glucose data to a smartphone app, instead of a separate receiver, allowing patients, parents and doctors to monitor glucose readings in real time. It was the latest step in a digital revolution for diabetes patients, but it was just the beginning for San Diego–based Dexcom, which had announced a few weeks before that it was teaming up with another company to create even smaller and cheaper monitors. That other company? Google.

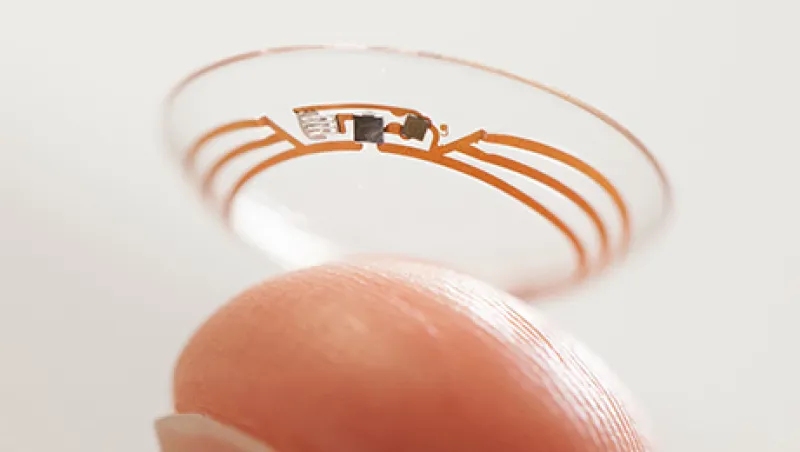

It’s no secret that Google has lofty ambitions to change the way the world sees health, in the same way that it disrupted the way people search for information and check e-mail. Google’s Calico project literally hopes to “cure death,” and its Life Sciences unit — recently renamed Verily — is working on various sensors and hardware to impact the discovery and management of disease. But Google’s interest in diabetes, through the Dexcom joint venture and its own in-house work on a glucose-monitoring contact lens, is what some experts say might make or break its foray into health. The industry gets more exciting by the day, but it can still be frustratingly bureaucratic, with regulators moving at a pace much slower than what many tech executives are used to.

“The FDA is struggling with how to get pulled into the current world, because as an agency, its first rule is ‘Do no harm,’” says Teresa McRoberts, manager of the Alger Health Sciences Fund at New York–based investment manager Fred Alger Management.

The agency is starting to promulgate some rules about what it needs to review when it comes to health care apps, which might put a chill on some tech innovation. So far, though, the specter of FDA scrutiny has meant that tech companies, from long-standing IT firms to start-ups, are focusing on software and products that track and manage data, mostly avoiding diagnosis and treatment.

There are a lot of reasons for tech companies to find a way to insert themselves into the health care world. Health care is one of the biggest engines of the U.S. economy, generating nearly $3 trillion each year, and the Patient Protection and Affordable Care Act, a shift toward higher-deductible plans and consumers’ growing comfort with tracking what they eat and how they move are piquing the interest of companies in many sectors.

The companies that are best placed to take advantage of these changes are those that really understand consumers, says Unity Stoakes, co-founder of StartUp Health, a global network of digital health start-ups that has had a hand in creating more than 100 new companies in the sector since its 2014 launch. Investments include AdhereTech, which has a smart pill bottle to help drugmakers track patients’ medication usage, and Edamam, which provides real-time nutrition analysis and meal recommendation to food and wellness companies. StartUp Health’s goal is to add 1,000 new companies to the digital health market over the next decade.

“Health care is already overly complex; what’s needed is new solutions in the marketplace that make it easy,” says Stoakes. “Companies like Apple have proven time and time again that when you create a beautiful experience for the consumer, you win.”

Apple’s Tim Cook has emphasized the company’s focus on the health care potential of the Apple Watch and poured resources into HealthKit and ResearchKit, which Cook expects will play a significant role in managing clinical data and assisting with clinical trials. But he said in a November interview with the Telegraph that whereas he doesn’t rule out an FDA-approved Apple product in the future, the watch itself won’t be going through that process. Cook said the FDA’s sluggishness would “hold [the company] back from innovating.”

The back end of health care — storing, managing and analyzing all of the data being gathered by apps as well as the ballooning number of electronic medical records — is where many believe technology companies will thrive, and some already are.

IBM’s Watson, a cloud-based technology system that uses machine learning to make sense of large amounts of information, shifted much of its focus to health data in 2015 after the April launch of the IBM Watson Health platform. The initiative quickly led to the acquisition of Merge Healthcare, a medical image processor, and joint ventures with Apple, CVS Health and Johnson & Johnson. IBM is so invested in the future of health care data management that it opened a new headquarters for Watson Health in Cambridge, Massachusetts.

Somewhere in the middle, between data gathering and management and creating products that might need regulatory approval, are companies like Uber Technologies, which surprised few in the digital health world when it announced a new flu shot delivery service in late 2014. It was a one-day initiative, known as UberHealth, that Uber brought back for an encore last fall to much media attention. Many experts believe is just the beginning of a huge new profit opportunity for the ride-hailing app. Every technology company with the means, it seems, is jumping into the fray.

“Prior barriers to participation in health care were largely based on the fact that the industry is built on really poor technology,” says Rich Gliklich, executive-in-residence with venture capital firm General Catalyst Partners and founder and former CEO and chairman of Outcome, a health IT company acquired in 2011 by Durham, North Carolina–based biopharmaceuticals research firm Quintiles. This need for interoperability is still easy to demonstrate when patients try to acquire copies of their own health records, Gliklich adds. But the barriers are dropping, and with them non–health care companies’ inhibitions about entering and profiting from the growing field.

The question of whether these companies will move very far outside the realm of collecting and managing data is still up in the air. The hesitancy to wade into FDA-regulated waters intensified after the agency stopped personal genomics company 23andMe from selling its kits to consumers for two years because of worries about how results would be interpreted. With 23andMe’s product now back on the market, albeit in a much different form, and Verily working with pharma giant Novartis to bring the glucose-monitoring contact lens to human trials, many eyes in the tech world will be on the FDA in 2016.