Scott Bauer, for CME Group

At a Glance:

- The Establishment Survey and Household Survey are two key data releases offering insights on the state of the economy.

- Employment data can help the Fed determine how well its current policy is working.

Often, a combination or even all these factors affect the market simultaneously. A new geopolitical issue arising could lead to an underwhelming or overwhelming economic data print, which may cause the Federal Reserve to act in a never-ending push and pull of external factors affecting the market.

Specifically in terms of economic data, the establishment survey and household survey are two employment data releases that the markets, financial analysts and traders watch very closely. Given that the Federal Reserve has started to cut rates, these reports are watched even more keenly than when there is no movement expected.

Establishment vs. Household Survey Insights

The establishment survey, also known as the Current Employment Statistics Program, is a monthly survey of approximately 119,000 businesses and agencies throughout the United States. The output of the monthly survey provides insight into nonfarm wage and jobs numbers at an industry level, estimating the month over month employment change in businesses, as well as the creation or dissolvement of companies in that period.The household survey, also known as the Current Population Survey, is designed to sample the population’s labor force and measure demographic-based employment trends. The household survey provides perspective into the labor force that the establishment survey does not cover, accounting for self-employed people, agricultural workers and other exceptions to being employed by a business. The most widely used output of the monthly household survey is the national unemployment rate.

A Soft Landing?

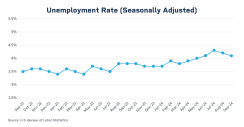

The labor market is the second part of the Fed’s “dual mandate” of maintaining healthy inflation and employment levels. The August jobs report from September 6 provided support that the labor market is cooling off as opposed to collapsing. While the U.S economy added fewer jobs than expected, the 142,000 additions was still a healthy number.The expectation that unemployment would drop in tandem with the jobs report came to fruition as the unemployment rate edged slightly lower to 4.2% from 4.3%. While the unemployment rate is still historically low, it has steadily risen over the past year.

Market Confidence

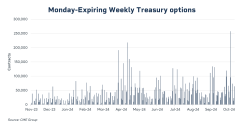

Releases in line with expectations may reassure investors, and the Fed, that the economy is still trending toward the coveted “soft landing.” Such a data print may signal to institutional investors that all is well, potentially reaffirming the bulls’ strength. For the Fed, it could signal that their policy is working as intended.In the September Jobs report from October 4 the unemployment rate fell slightly again to 4.1% and the U.S. added more jobs than expected. Monday-expiring CME Group Treasury options volume spiked to a record 257K contracts on the day of the release, fueled by strong non-farm payrolls data from the establishment survey.

There are a myriad of external factors that push and pull the market daily, and data releases are just one part of the picture.