2024 looks to be the year of the pivot as the Federal Reserve tames inflation while the economy remains resilient. John Fekete, Crescent Capital Group’s Head of Capital Markets, discusses the state of the U.S. economy and the outlook for debt markets.

What was the biggest story of 2023?

The biggest story of 2023 was the durability of the U.S. economy. One of the most widely anticipated recessions in history never materialized, so many of the prognosticators were just plain wrong. Back in July, we published a commentary called “We’re not out of the woods yet, but time to step in” where we mentioned we were on the bullish side of the recession debate and called attention to the attractiveness of the high yield bond and bank loan markets. The yield curve inversion proved to be an imperfect indicator while labor market strength proved prescient. We learned it was possible for the Fed to dramatically dampen inflation without sacrificing jobs—achieving its two mandates simultaneously.

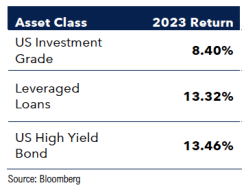

How did 2023 shape up for high yield bond and syndicated loan investors?

It seems a lot has changed over the past quarter. Has the rally gotten ahead of itself?

What is your outlook for credit in 2024?

Do you have a favorite fixed income sector right now?

With base rates sitting around 5.3% floating rate instruments like syndicated bank loans and CLO debt offer near double-digit coupons, providing a significant carry pick-up over fixed coupon bonds. It would take a rapid decline in interest rates for high yield bonds to outperform syndicated loans and CLO debt, so we have an allocation preference for floating rate sectors in multi-asset portfolios.

What risks do you see now and as 2024 progresses?

One risk that receives little attention is that global fiscal deficits are out of control. Sovereign debt issuance is soaring. According to the Financial Times, the U.S. Treasury will issue approximately $4 trillion of bonds this year with a maturity of two to 30 years, up from $3 trillion last year and $2.3 trillion in 2018. Furthermore, national elections will occur in more than 50 countries in 2024, home to half the planet’s population. History shows that politicians boost public spending rather than exercise fiscal restraint in election years. This is a concern for investors, including us, but it is a slow-moving train and one that won’t likely have a material near-term impact. The biggest immediate risk I see facing investors is the risk of falling into the same trap they have for the last two years –underestimating the strength of the U.S. economy and the ability of the Fed to break inflation without millions of Americans losing their jobs.What about interest coverage and defaults? They have been a recent focus for investors.

Coupons, or the rates borrowers pay, are likely to be at or near their peaks with the rate hiking cycle concluding in the U.S. While still-high interest rates may pressure certain borrowers, many have adequate liquidity and would likely benefit from private equity sponsor support if needed.We have lowered our 2024 corporate default outlook to 3-5% from 4-6% as financial conditions have dramatically eased since November. And recoveries post-default, which have been well below historical averages, are stabilizing. After dipping below 60% in 2Q 2023, syndicated loan recoveries have modestly increased to 45% while high yield recoveries have been steady at 43% according to UBS. A word from years of experience of seeing calm after a storm—do not underestimate the casualties. We approach underwriting with extreme care and diligence to avoid tailwind complacency.

ABOUT CRESCENT CAPITAL

Crescent is a global credit investment manager with over $40 billion of assets under management as of September 30, 2023. For over 30 years, the firm has focused on below investment grade credit through strategies that invest in marketable and privately originated debt securities including senior bank loans, high yield bonds, as well as private senior, unitranche and junior debt securities. Crescent is headquartered in Los Angeles with offices in New York, Boston, Chicago and London with more than 200 employees globally. Crescent is a part of SLC Management, the institutional alternatives and traditional asset management business of Sun Life. For more information about Crescent, visit www.crescentcap.com.

LEGAL INFORMATION & DISCLOSURES

This document expresses the views of the author as of the date indicated and such views are subject to change without notice. Neither the author nor Crescent Capital Group LP (“Crescent”) has any duty or obligation to update the information contained herein. Further, Crescent makes no representation, and it should not be assumed, that past investment performance is an indication of future results.

Crescent makes this document available for informational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Nor is the information intended to be nor should it be construed to be investment advice. Certain information contained herein concerning economic trends and performance may be based on or derived from information provided by independent third-party sources. The author and Crescent believe that the sources from which such information has been obtained are reliable; however, neither can guarantee the accuracy of such information nor have independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This document, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Crescent.