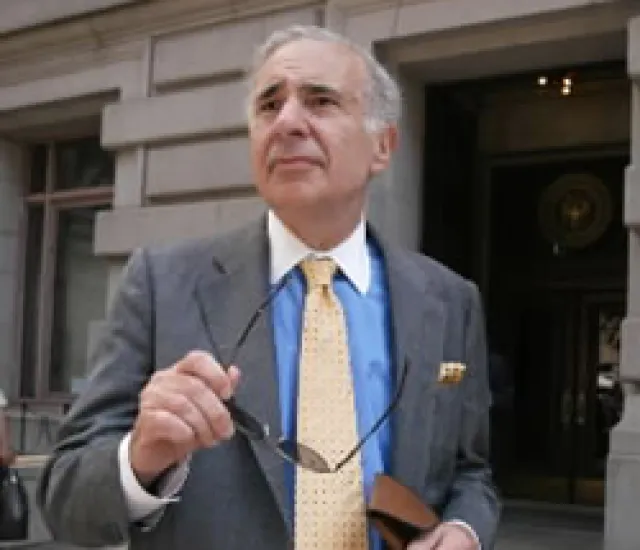

Carl Icahn Is Eyeing Motorola Solutions

Carl Icahn is still battling over chemicals company Clorox, as well as a variety of other activist positions, but Motorola Solutions is a much more likely target for him.

Stephen Taub

August 19, 2011