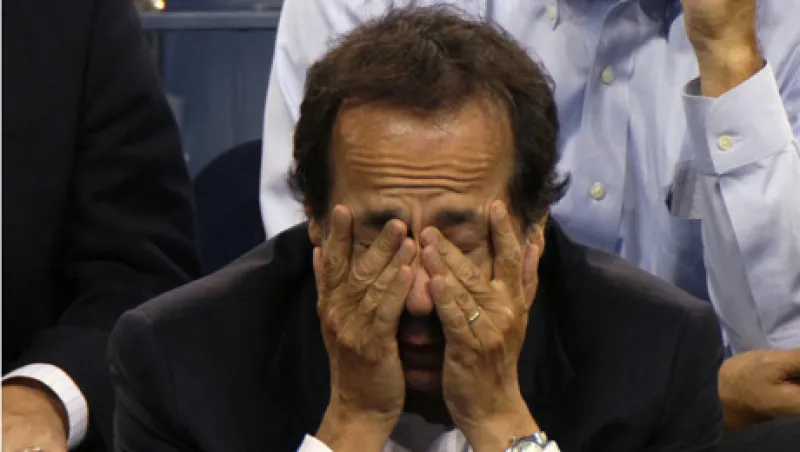

John Paulson, president and co-fund manager of Paulson & Co. Inc., attends a tennis match during U.S. Open at the Billie Jean King National Tennis Center in New York, U.S., on Tuesday, Aug. 30, 2011. Paulson and his wife, Jenny, had planned to host a fund-raiser for Republican presidential hopeful Mitt Romney at their estate in Southampton on Sunday but it was postponed due to Hurricane Irene, according to Wall Street Journal. Photographer: Rick Maiman/Bloomberg *** Local Caption *** John Paulson

Rick Maiman/Bloomberg