Rather than obsessing about the timing of the next Federal Reserve interest rate hike, investors would do well to focus on where policy rates will end up in the long run. At the heart of this matter are demographics. Long-term interest rates, inflation and economic growth all face the structural headwinds of an aging population, but many investors have yet to come to terms with this factor. Still, there are at least signs that the debate is turning in the right direction.

The latest to shift the policy debate to a long-term focus is San Francisco Fed president John C. Williams. In an August 15 commentary, Williams suggested that in the context of lower long-term terminal interest rates, also known as r-stars, it might be necessary for the Fed to either pursue a higher inflation target (giving the central bank more room to maneuver in the event of an economic downturn) or replace the inflation component of its dual mandate entirely with nominal GDP targeting. Both proposals would be a very significant change to the central bank’s policy framework, and given the theme of the 2016 Kansas City Fed Jackson Hole symposium, “Designing Resilient Monetary Policy Frameworks for the Future,” we at BlackRock doubt the timing of the commentary was accidental. Still, Federal Reserve chair Janet Yellen’s remarks at the conference highlighted that these proposals were not actively under consideration at this point, although she acknowledged that they deserve further research.

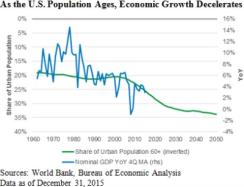

In our view, the utility of extraordinarily low interest rate levels has long since passed the point of having any meaningful impact on real economic growth and, for some time now, has solely been influencing the financial economy as a price-supporting mechanism. Thus, whereas we think investors are still excessively focusing on short-end interest rates, which continue to be distracting and hold little if any influence on the current economic or inflation trajectory, we are somewhat encouraged by these recent discussions on how rates are likely to play out over the long term. The world we live in, as many are now recognizing, is being driven by a demographic evolution that takes a very meaningful haircut off normal run-rate levels of growth (see chart), as well as by a historic technological revolution that continues to change the fabric of today’s economy.

Until recently, we have only had very general guesses as to the degree of economic growth impairment that might result from the aging of the U.S. population. But a recent study from RAND Corp. is helping to shed greater light on the issue. More specifically, RAND economist David Powell and his co-authors utilized empirical data across the U.S. from 1980 to 2010 to estimate the impact of aging on per capita economic output. The novelty of their approach is that, rather than attempting to forecast the influence of future population aging across multiple economic and policy jurisdictions, this study uses realized aging dynamics and changes in rates of growth and is focused solely on the U.S.

The authors of the RAND research maintain that the proportion of the U.S. population that is age 60 or older will grow by 39 percent between 2010 and 2050, which holds “the potential to negatively impact the performance of the economy as well as the sustainability of government entitlement programs,” and we would add that monetary policy is likely to hold little to no influence over that trend. Further — and fascinatingly — the authors contend that “a 10 percent increase in the fraction of the population ages 60+ decreases the growth rate of GDP per capita by 5.5 percent. ... [The authors’] results imply annual GDP growth will slow by 1.2 percentage points this decade and 0.6 percentage points next decade due to population aging.” Clearly, this is a remarkable and still largely underappreciated headwind to growth, inflation and the long-term level of policy rates.

As a result, this dynamic demands that greater attention be paid by both fiscal and monetary policymakers and, of course, by investors, who now have to navigate the challenges posed by allocating capital in an environment that is likely to offer lower absolute levels of yield and total return. On the policy front, we have long argued that the baton must now be transferred from monetary authorities to the fiscal channel, if we are to see any meaningful rerating of economic growth in the U.S. and further stabilization of global growth. Both the possibility of future fiscal policy support and the continuation of extraordinary monetary policy have political elements to them. The degree to which the asset inflation of recent years has benefited the already wealthy and left middle classes behind, relatively speaking, could well influence the policy path forward via the ballot box.

In a sense, then, investing for a cyclical time horizon requires balancing the risk of deflationary global impulses abroad, from the waning of the commodity supercycle and currency devaluation wars, against upward pressure in U.S. core inflation and stable — if unimpressive — economic growth. Therefore, over the short-to-medium term, getting the inflation call right is one of the most important decisions an asset manager can make. Secularly, however, asset managers will need to come to grips with the headwinds to economic growth, inflation and interest rates that are likely to make hitting currently established return targets very difficult.

Rick Rieder is chief investment officer of global fixed income for BlackRock in New York.

Get more on macro.