Let’s assume that a retiree has done everything right leading up to retirement—he invested early on in his career with adequate equity exposure, maxed out his retirement contributions, and de-risked his portfolio at an opportune time. Now, the most important thing on his mind is pursuing his retirement aspirations while keeping an eye on expenses. One thing that’s easy to overlook, though, is the impact that inflation can have on a retiree’s savings.

“Inflation has been running at less than 1%, well below the average inflation rate of 2.6% since 1986, so it’s not really top of mind for many people entering retirement,” says Michael Rosenberg, head of IODC Distribution at Prudential Investments. But despite the absence of broad-based inflationary pressures in the current economic environment, the effects of even low inflation rates can add up and compound over time to have a significant impact.

INVESTORS’ TOP FINANCIAL GOALS

- Not outlive money

- Afford medical care

- Maintain desired lifestyle

SHOULD INFLATION BE A CONCERN?

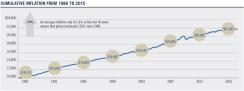

Consider that over the past 30 years consumer prices have more than doubled. This means that participants retiring today at age 65, who could be looking at 30 years or more in retirement, could see nearly everything they need to purchase double in cost should inflation revert back to historical levels.

Source: Calculated by Prudential Investments LLC using data presented in Morningstar software products. All rights reserved. Used with permission. Inflation is measured by the Consumer Price Index (CPI), which is a measure of the average price of consumer goods and services purchased by households. All data as of December 31st of each year.

While perhaps not an immediate concern for many consumers, inflation is a valid concern for retirees. With high and rising levels of debt-to-GDP, unconventional monetary policy, lower unemployment, and the reduction of excess capacity in the economy, the U.S. faces the potential for higher inflation over the long term. “Should inflation pick up, the purchasing power of a retiree’s lifetime of savings could be eroded in a short period of time,” stresses Rosenberg.

INFLATION IN RETIREMENT LOOKS DIFFERENT

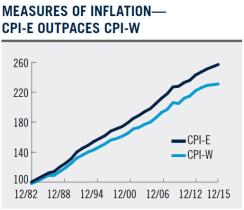

It’s also important to consider that retirees are generally subject to different, and higher, inflationary pressures than those in the workforce. The reason inflation looks different in retirement is due to the higher degree of inflation associated with the basket of goods and services that retirees tend to purchase such as health care, housing, and food. Exacerbating these inflationary pressures is the fact that Social Security doesn’t adequately address the erosion of a retiree’s purchasing power. Social Security benefits are adjusted based on changes in CPI-W (wage earners inflation), which has been considerably outpaced by CPI-E, a measure that better reflects the inflation experienced by those in retirement.

Source: As of 3/31/2015. Calculated by Prudential Investments LLC and assumes 5% annual rate of return.

While perhaps extreme, the example below exemplifies the erosive effect inflation can have on the purchasing power of a retirement portfolio. Suppose an investor enters retirement with a beginning portfolio balance of $1 million. Assuming a 5% annual rate of return and 1% inflation, the investor has 41 years to draw on his savings until he exhausts his assets. If inflation were to increase to 5%, the picture changes dramatically. The retiree would lose 20 years’ worth of annual withdrawals.

Source: Bureau of Labor Statistics: CPI-E and CPI-W December 1982. Experimental Consumer Price Index for Elderly Americans uses a basket of goods adjusted to more closely weigh the goods purchased by those in retirement.

Concerns about rising health care costs are top of mind to investors. A Prudential study[1] found that for 75% of Americans, the most important financial goal is not running out of money in retirement. Affording medical care was the second most important priority for 68% of respondents—a reasonable concern given that average medical care inflation has consistently outpaced headline inflation over the past 30 years. In fact, medical inflation has increased at an average annual rate of 4.6% over the past 30-year period ended 12/31/2015 compared to headline inflation’s 2.6%.

It’s worth noting that study respondents also perceived health care costs, changes to Social Security, and inflation to be the top three threats to achieving retirement success.

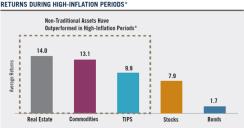

Allocating to asset classes that have performed well during inflationary periods can help reduce the impact of inflation on purchasing power.

–JEREMY STEMPIEN, QMA

INFLATION-FIGHTING INVESTMENTS

There are a number of asset classes designed to hedge inflation. Should inflation pick up, having exposure to real estate, commodities, and TIPS can benefit an investor’s portfolio. “During retirement, we believe allocating a large percentage to asset classes that have historically performed well during inflationary periods can help reduce the impact of inflation on purchasing power,” says Jeremy Stempien, product specialist on QMA’s Asset Allocation team.

Image 4: RETURNS DURING HIGH-INFLATION PERIODS*

Source: Morningstar as of 3/31/15. Calculated by Prudential Investments LLC using data from Morningstar. All rights reserved. Used with permission. Indexes are unmanaged and do not take into account fees and expenses. Asset classes in chart represented by the following indices: Bloomberg Commodity Index (Commodities), NCREIF–Open End Diversified Core Equity Index (Real Estate), Barclays U.S. TIPS Index (TIPS), S&P 500 Index (Stocks), and Barclays U.S. Aggregate Bond Index (Bonds).

* High-inflation calendar years: 1996, 2000, 2004, 2005, and 2007. Median inflation for the period January 1950–December 2015: 3.60%.

At the end of the day, inflation really does matter, especially for retirees. Because inflation looks different for retirees versus the general population, it’s important that their portfolios are positioned appropriately to protect purchasing power and keep them on course to achieving successful retirement outcomes.

DEFINITIONS

Inflation: The level of increase in prices and the subsequent fall in purchasing value of money.

CPI: A measure of inflation that examines the weighted average of prices of a basket of consumer goods and services.

Barclays U.S. Aggregate Bond Index represents securities that are SEC registered, taxable, and dollar denominated. The index covers the U.S. investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Barclays U.S. TIPS Index includes all publicly issued, U.S. Treasury inflation-protected securities that have at least one year remaining to maturity, are rated investment grade, and have $250 million or more of outstanding face value.

Bloomberg Commodities Index (formerly Dow Jones UBS Commodities Index) is composed of futures contracts on physical commodities traded on U.S. exchanges, with the exception of aluminum, nickel, and zinc, which trade on the London Metal Exchange.

NCREIF-Open End Diversified Core Equity Index is an index of investment returns reporting on both a historical and current basis the results of 30 open-end commingled funds pursuing a core investment strategy.

S&P 500® Index is an unmanaged index that includes 500 leading companies in the leading industries of the U.S. economy, capturing 75% coverage of U.S. equities.

Indices are unmanaged and an investment cannot be made directly into an index.

RISKS

Investing involves risk. Some investments are riskier than others. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost, and it is possible to lose money. Past performance does not guarantee future results. Asset allocation and diversification do not assure a profit or protect against loss in declining markets.

The target date is the approximate date when investors plan to retire and may begin withdrawing their money. The asset allocation of the target date funds will become more conservative as the target date approaches by lessening the equity exposure and increasing the exposure in fixed income-type investments. The principal value of an investment in a target date fund is not guaranteed at any time, including the target date. There is no guarantee that the fund will provide adequate retirement income.

A target date fund should not be selected based solely on age or retirement date. Participants should carefully consider the investment objectives, risks, charges, and expenses of any fund before investing. Funds are not guaranteed investments, and the stated asset allocation may be subject to change. It is possible to lose money by investing in securities, including losses near and following retirement.

PRUDENTIAL INVESTMENTS

Prudential Investments® strives to be a leader in a broad range of investments to help you stay on course to the future you envision. Our investment professionals also manage money for major corporations and pension funds around the world, which means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors. We are part of Prudential Financial, a company America has been bringing its challenges to for more than 140 years. Bring us yours.

QMA

Since 1975, QMA has served investors by combining experienced judgment with detailed investment research with the goal of capturing repeatable long-term outperformance. As of December 2015, we manage approximately $113 billion in assets globally for institutions, subadvisory clients, and individual investors through a broad mix of asset allocation, core equity, value equity, and indexing solutions.

CONTACT YOUR FINANCIAL PROFESSIONAL OR PLAN ADMINISTRATOR.

QMA is the primary business name of Quantitative Management Associates LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), a Prudential Financial company, member SIPC. © 2016 Prudential Financial, Inc. and its related entities. The Prudential logo and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.