One of the key themes of this year will be the shift in central bank policy and its impact on asset pricing. The Fed is leading the way, but others are preparing their exit strategies. Should you be nervous about normalisation?

The Fed at the forefront

After a decade of unprecedentedly loose monetary policy, the Fed hiked rates three times in 2017 and, by the end of the year, had also begun reducing the size of its balance sheet. It was able to do so because of the strong growth of the US economy. Though there is no guarantee growth will continue, this strength shows no sign of waning just yet, so Lyxor expects further rate hikes this year, starting in March. The only question is how many, with three currently looking likeliest in our view. Higher growth could force the Fed to act faster.

Next in line: the ECB

Other major central banks look likely to follow in the Fed’s footsteps, and first in line is the ECB. For the moment, it’s still adding to its balance sheet by buying assets as part of its quantitative easing programme, although it’s doing so more slowly: it has reduced its monthly purchases from €60 billion to €30 billion. What’s more, it has stated it will conclude these purchases by the end of September. When it comes to tightening policy, the ECB remains well behind the Fed, with its key policy rate still at 0 percent. It’s believed that the ECB will only start raising rates well after the conclusion of its asset purchases, which means hikes are unlikely before 2019 in our opinion. Should growth surprise to the upside, don’t rule out a late 2018 hike.

Tightening further over the horizon in Japan

After the ECB, the Bank of Japan is likely to be next. It hasn’t really discussed reducing its asset purchases in earnest yet, but it does seem to have been testing the water recently by referring to a form of tapering. We believe this remains some way off however: formal announcements are unlikely until the second half of this year, with actual implementation taking place in 2019.

The BoE strikes out on its own (for now)

The Bank of England is something of an outlier as it battles the uncertainties of Brexit. Much depends on the UK’s progress towards a good trade deal with the EU: should this materialise, it would open the door to rate hikes further down the line.

A mixed picture in emerging markets

What about monetary policy in the emerging world? There’s a difference between those economies compelled to follow Fed policy – Korea has recently hiked rates, for example – and those like China, which have a greater degree of independence.Inflation is fairly moderate in China so its central bank hasn’t felt the need to hike rates at the same pace as the Fed and is currently adopting a neutral stance. Inflation is higher in countries like Turkey and South Africa, so they could see hikes over the coming months. Look out for India, where the central bank is turning more hawkish. Elsewhere, the Brazilian and Russian central banks remain in a very accommodative mood.

The implications for investors

Should investors be worried about the end of ultra-loose monetary policy? We’re concerned about its implications for fixed income, but more sanguine about the outlook for equities.More: Lyxor cuts fees on European ETFs

Bearish on bonds...

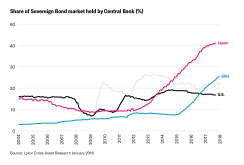

We’re increasingly cautious on fixed income and believe protection may be harder to find among traditional strategies. As policy rates rise, bond yields are likely to move higher at the short-end of the curve. What’s more, with the Fed already selling assets we suspect there are even implications for longer-dated issues such as the 10-year Treasuries, albeit they still something of a safe haven.Having favoured an underweight US Treasury position for some months, we feel the time has now come to adopt similar stances in eurozone fixed income and Japanese government bonds. We’re also cautious about corporate bonds – and US high yield in particular – as well as emerging market sovereigns denominated in US dollars. With the Fed hiking rates, these risky assets will lose some of their allure relative to risk-free assets such as US Treasuries.

It could be time to consider using less conventional strategies like inflation breakevens and floaters, which are capable of offering some protection against rising rates and inflation. The so-called “base effect” in oil prices will be even stronger in the coming months provided that oil prices stay at current levels, which seems likely due to solid macro conditions globally. Those conditions, allied to the moderate wage pressures observed in developed countries, led us to upgrade USD breakevens to overweight recently.

...but optimistic about equities

Tighter policy is also a headwind for the equity markets, but there are strong forces at play which make us more optimistic about the prospects for stocks:

- Accommodation will only be reversed very gradually – in stark contrast to the aggressive way in which it was implemented a decade ago. That should soothe any troubled minds among investors.

- The global economy should continue to strengthen – the eurozone is enjoying its strongest expansion for a decade, the US economy is performing well, Japan is recovering, and it’s clear emerging markets – especially China – are doing better than had been feared just a few months ago. Stronger economies should mean stronger earnings growth and buoyant equity markets.

Selective in emerging markets

Monetary tightening in certain emerging economies is likely to represent a headwind to risky assets from those countries, but China’s seemingly sustainable growth should, in our view provide support to emerging market risk assets overall. At the country level, we’re overweight Brazil and Russia, and neutral in India and China.Other things on your horizon? Watch our videos on the themes likeliest to move markets in 2018.

Disclaimers:

FOR PROFESSIONAL CLIENTS ONLY

All opinions/data sourced from Lyxor & SG Cross Asset Research teams. Opinions expressed are as at 2 February 2018. Past performance is no guide to future returns.

This document is for the exclusive use of investors acting on their own account and categorised either as “Eligible Counterparties” or “Professional Clients” within the meaning of Markets In Financial Instruments Directive 2004/39/EC.

This document is of a commercial nature and not of a regulatory nature. This document does not constitute an offer, or an invitation to make an offer, from Société Générale, Lyxor International Asset Management or any of their respective affiliates or subsidiaries to purchase or sell the product referred to herein.

We recommend to investors who wish to obtain further information on their tax status that they seek assistance from their tax advisor. The attention of the investor is drawn to the fact that the net asset value stated in this document (as the case may be) cannot be used as a basis for subscriptions and/or redemptions. The market information displayed in this document is based on data at a given moment and may change from time to time. The figures relating to past performances refer or relate to past periods and are not a reliable indicator of future results. This also applies to historical market data. The potential return may be reduced by the effect of commissions, fees, taxes or other charges borne by the investor.

Lyxor International Asset Management (Lyxor ETF), société par actions simplifiée having its registered office at Tours Société Générale, 17 cours Valmy, 92800 Puteaux (France), 418 862 215 RCS Nanterre, is authorized and regulated by the Autorité des Marchés Financiers (AMF) under the UCITS Directive and the AIFM Directive (2011/31/EU). Lyxor ETF is represented in the UK by Lyxor Asset Management UK LLP, which is authorised and regulated by the Financial Conduct Authority in the UK under Registration Number 435658.

Lyxor International Asset Management (“LIAM”) or its employees may have or maintain business relationships with companies covered in its research reports. As a result, investors should be aware that LIAM and its employees may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

CONFLICTS OF INTEREST

This communication contains the views, opinions and recommendations of Lyxor International Asset Management (“LIAM”) Cross Asset and ETF research analysts and/or strategists. To the extent that this research contains trade ideas based on macro views of economic market conditions or relative value, it may differ from the fundamental Cross Asset and ETF Research opinions and recommendations contained in Cross Asset and ETF Research sector or company research reports and from the views and opinions of other departments of LIAM and its affiliates. Lyxor Cross Asset and ETF research analysts and/or strategists routinely consult with LIAM sales and portfolio management personnel regarding market information including, but not limited to, pricing, spread levels and trading activity of ETFs tracking equity, fixed income and commodity indices. Trading desks may trade, or have traded, as principal on the basis of the research analyst(s) views and reports. Lyxor has mandatory research policies and procedures that are reasonably designed to (i) ensure that purported facts in research reports are based on reliable information and (ii) to prevent improper selective or tiered dissemination of research reports. In addition, research analysts receive compensation based, in part, on the quality and accuracy of their analysis, client feedback, competitive factors and LIAM’s total revenues including revenues from management fees and investment advisory fees and distribution fees. Please see our investment recommendations disclosure website www.lyxoretf.com/compliance.