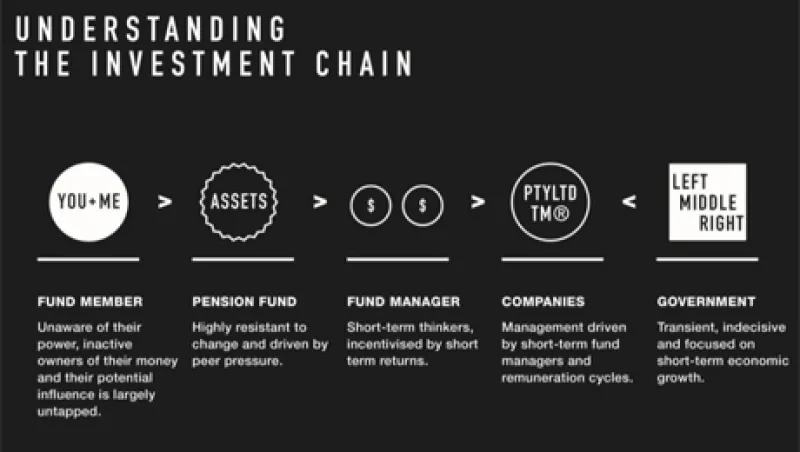

A few weeks back I wrote a post on the inherent principal-agent problems embedded in the investment management industry. In large part, I argued that these problems are due to the long chain of agents required for asset owners to actually invest money in companies; I think the long chain distorts and diverts the asset owners original motives in ways that end up maximizing the welfare of the agents. That's not ideal. And, in fact, it's these distortions and diversions that shorten the time horizon of the investment management industry and, ultimately, lead to a less sustainable form of finance and indeed capitalism. Why do I bring all this up? Because I was just reading this interesting new report by the Asset Owners Disclosure Project, and I came across the neat little graphic below. I think it offers a simple and indeed lovely depiction of the generic problems with finance today. So... take a gander.