Chinese equity markets were rattled by another senior executive gone missing as Beijing’s retribution for past market excesses continues unabated. Trading in the stock of Fosun International was suspended by the Hong Kong Stock Exchange after the company announced that it had lost contact with its CEO. As the Communist Party continues to crack down on corruption, the yuan slid sharply against the dollar, declining by nearly 0.3 percent after the People’s Bank of China loosened its currency-reference target on Thursday.

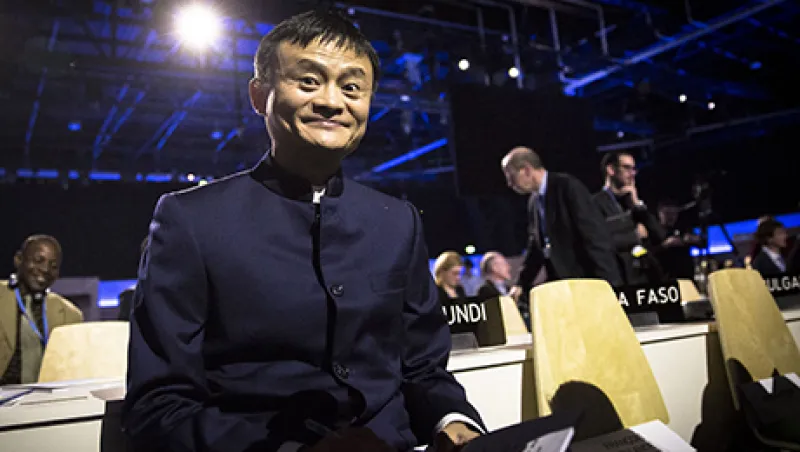

Alibaba to buy Hong Kong newspaper. On Friday Chinese ecommerce giant Alibaba Group Holding announced that one of its divisions would buy the venerable South China Morning Post, marking the largest media merger in China to date. The Hong Kong publication, which traces its history back by more than a century, is the largest English language publication in the region.

South Africa Currency Crisis. The South African rand declined lower than 16 per dollar in trading this morning as a combination of declining metals prices and a politically motivated shakeup at the nation’s central bank rattled markets. The abrupt replacement of Nhlanhla Nene by David van Rooyen came as a shock. Credit agencies have raised doubts about the largest African economy’s long-term prospects.

Shoppers pick up pace in November. U.S. retail sales data released today by the Commerce Department indicated that Americans were willing to open their wallets with November with the headline index rising by 0.2 percent for the month to best consensus forecasts. Restaurant sales were particularly strong at 0.7 percent versus October.

Mutual fund to suspend withdrawals. Third Avenue Management LLC, the fund management firm controlled by legendary distressed investor Martin Whitman will suspend client redemptions while it liquidates the portfolio for a mutual fund it oversees. The company indicated that the move is prompted by liquidity issues.

China oil supplies swell. National Bureau of Statistics data released on Friday revealed that strategic reserves in the nation roughly doubled year-to-date with more than 191 million barrels in reserves. Additionally, Beijing disclosed that it has expanded storage capacity significantly.