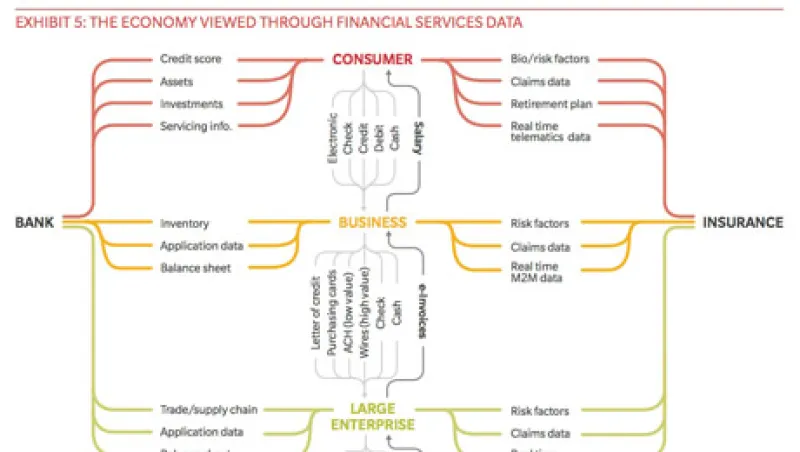

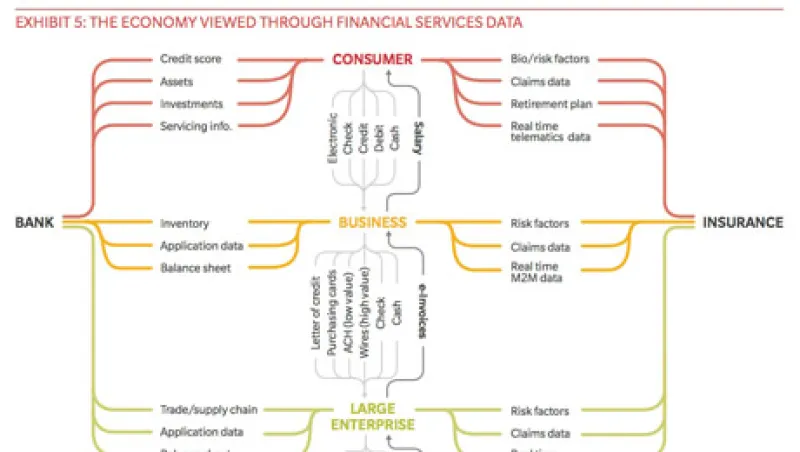

Financial Services Data Companies. Let’s Start One!

The amount of financial services data that must be collected, vetted, cleansed, managed, packaged, analyzed and then presented in a digestible manner is… mind-boggling. And I have a hard to time believing that a lumbering financial services firm will get this right. Enter my new startup: ‘KickCrowdBox’. Let me explain what we’re doing…

Ashby Monk

February 20, 2013