Not even the King of Bonds could escape the carnage when Federal Reserve chairman Ben Bernanke intimated this spring that later this year the central bank would reduce its monthly purchases of U.S. Treasuries and mortgage securities, sending interest rates soaring. In the second quarter, a whopping $17.7 billion in net assets fled Pacific Investment Management Co.'s Core Plus — Total Return Full Authority strategy, managed by bond guru Bill Gross, according to Atlanta-based eVestment, which tracks data on 53,000 funds held by investors. The exodus reflects a broader shift in bond asset allocation as institutional investors search globally for yield.

With $476 billion in assets, the Pimco strategy combines core medium-term U.S. bond assets, such as Treasuries, with investment-grade, higher-yielding bonds that together raise the total return of the portfolio. The bulk of the assets reside in the $261.7 billion Total Return Fund, which Pimco co-founder and co-CIO Gross has run since 1987.

Pimco's huge net outflows from its Core Plus — Total Return strategy are due at least in part to rising interest rates, says Michael Rawson, a fund analyst at Chicago-based Morningstar who analyzes shifts in asset allocations. Indeed, rising interest rates prompted institutional investors around the world to cut back their exposure to fixed-income assets during the second quarter, as well as to reshuffle allocations among fixed-income classes.

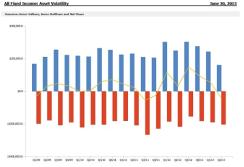

Institutional investors withdrew a net $41.6 billion from fixed-income funds in the quarter ended June 30, according to eVestment. U.S. fixed-income assets alone experienced a net outflow of $43 billion. Those outflows stand in stark contrast to the previous five quarters, which saw a total net inflow of $445.5 billion into fixed-income funds.

Source: eVestment (Click image to enlarge) |

Pimco benefited from the increased interest in fixed-income funds that invest globally. The firm saw a $5.47 billion net inflow into its Unconstrained Bond Fund, pushing its assets under management to $35.4 billion. In July, the fund was the most frequently searched strategy in the eVestment database, which portends well for future inflows.

Rising interest rates may not necessarily lead to a corresponding exodus from fixed-income products, argues Sabrina Callin, the Newport Beach, California–based product manager for the Unconstrained Bond Fund. Instead, she expects investors to shift some of their fixed-income portfolios into actively managed funds like hers rather than rely on a core U.S. bond aggregate index.

"Fixed income, as an asset class — especially high-quality fixed income — is a very powerful risk diversifier, and that continues to resonate with investors," says Callin. By turning to actively managed bond funds and strategies like Pimco's Unconstrained Bond Fund, "investors can also benefit from alpha or higher risk-adjusted returns," she adds.

For its part, the bond market is still reeling from the spike in interest rates that began in earnest in May, when Bernanke first talked about tapering the size of the Fed's $85 billion in monthly bond purchases. The yield on the ten-year Treasury rose from 1.97 percent on May 21 (before Bernanke's comments) to 2.52 percent by the end of June, rising as high as 2.90 percent earlier this month.

"The market is on edge over the impact of the Fed's tapering," says Morningstar's Rawson. "It's somewhat ironic, because the Fed has made it clear they are not planning to actively increase the federal funds rates until 2016."

Get insights and market analysis from Pimco on Institutional Investor's Global Market Thought Leaders blog.