The brightest and most creative minds in the hedge fund industry will be under one roof Wednesday when Delivering Alpha convenes at the Pierre Hotel in New York City. Now in its third year, the conference has established itself as a preeminent event at which top managers and investors talk shop.

For the third straight year, Delivering Alpha starts with a bang — an interview with the current U.S. Treasury Secretary (this time it's Jack Lew). At last year's meeting then–Treasury Secretary Timothy Geithner kicked off the day with a wide-ranging interview by CNBC's Larry Kudlow, host of the nightly Kudlow Report. Private equity giant Henry Kravis delivered the lunch keynote as attendees tried to listen between bites of filet. And, of course, U.S. Attorney for the Southern District of New York Preet Bharara — the sheriff of Wall Street — was extremely candid, and funny, in his sit-down with Mad Money's Jim Cramer.

This year, it only gets better.

Bharara will return on Wednesday, and with apologies to all who will be in attendance, he will probably have enough subpoenas this time around. One of the U.S.'s more recognizable lawyers has become a household name in the industry as insider-trading cases engulf the news.

This year's panelists represent some of the smartest names in the investment game. Joining holdovers Leon Cooperman of Omega Advisors and Jim Chanos of Kynikos Associates on the must-see My New Best Idea panel are Delivering Alpha newcomers Chris Hohn of the Children's Investment Fund Management (UK) and Mark Kingdon of Kingdon Capital Management. Hohn's former boss Richard Perry will be back on the Global Stage panel, along with J.P. Morgan Asset Management CEO Mary Callahan Erdoes and Harvard Management Co. chief Jane Mendillo to discuss the world at large and the investment opportunities in it. They will be joined by Bridgewater Associates co-president David McCormick.

Another new name to grace Delivering Alpha this year will be Farallon Capital Management managing partner Andrew J.M. Spokes, who took over from founder Thomas Steyer after he retired at the end of 2012. The new head of the approximately $19 billion San Francisco–based firm shares a panel with Morgan Stanley Investment Management president Gregory Fleming, CQS founder and CEO Michael Hintze and Canyon Capital co-founder Joshua Friedman to talk about one of the most intriguing issues that investors face today — the great rotation from bonds to stocks.

If the cost of admission weren't enough to keep attendees in their seats the whole day, the final panel of the day should do so. Fortress Investment Group principal Michael Novogratz, Grosvenor Capital Management CEO Michael Sacks, Pine River Capital Management head of fixed income trading Steve Kuhn and Wisconsin Investment Board CIO David Villa will talk bubbles and the effect of crowd mentality in investing.

Outside of the panelists, the one-on-one interview subjects are sure to enlighten, entertain and energize conference goers.

This year's lunch will be spent with the man behind what some have called "the greatest trade ever." Recently, however, John Paulson's gold gamble has not paid off, with Paulson & Co.'s gold fund losing 23 percent in the month of June. Other funds, including the Credit Opportunities and Paulson Partners funds, were also down for June, though the funds were up 12 percent and 8 percent on the year, respectively.

Trian Fund Management co-founder Nelson Peltz also joins the fun as an "Alpha Agitator." The serial board member, who has no relation to Institutional Investor Editor Michael Peltz, has delivered a 12 percent-plus return for the first six months of this year. He is currently the non-executive chairman of restaurant chain Wendy's Group, in addition to sitting on several other boards of directors. Before founding Trian in 2005, Peltz was active in corporate acquisitions, and at one time owned the beverage company Snapple, before selling it to Cadbury Schweppes. As an investor, Peltz is known for his hands-on approach, spending lots of time with management and boards of directors of the companies in which he invests.

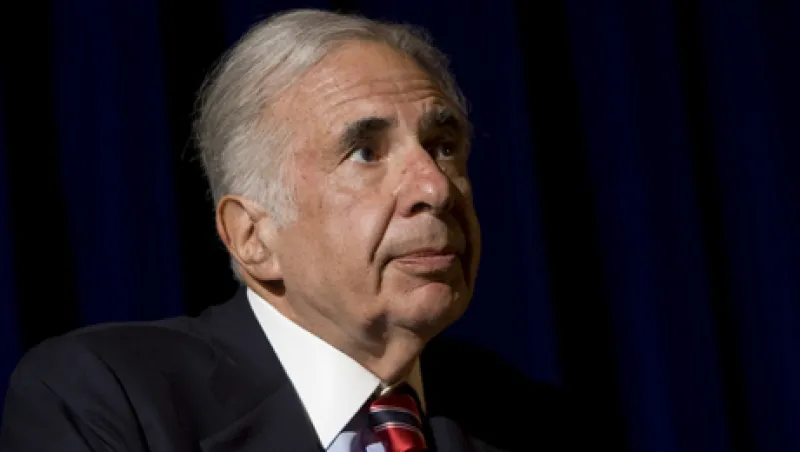

Perhaps the most enticing speaker is the oldest, Carl Icahn. At 77, Icahn is as active as ever in the investing world and should have plenty on his mind to discuss at Wednesday's conference. His current fight with Michael Dell and the tech giant's eponymous computer company has been front-page news for months, as the billionaires have traded barbs while restructuring offers and soliciting ballots ahead of the following day's shareholder vote. He will close out a long day of alpha-talk — and usher a tired lot of listeners to the cocktail hour.

Delivering Alpha is about just that — alpha, or outperformance. Finding meaningful investment returns requires more than just hard work and smarts; it takes cunning, precision and, yes, even a little luck. Delivering alpha doesn't come easy — Alphas are "so frightfully clever," Aldous Huxley wrote in his 1930s dystopic novel, Brave New World . There are no shortcuts to finding value, whether in equities, bonds, energy, health care or any other asset class or investment area.

On Wednesday, those professionals taking the stage at the Pierre Hotel have attempted to navigate these waters, and will share what they've discovered. If you can't be there in person, be sure to come to institutionalinvestor.com or follow us on twitter for full coverage of the conference.